Cerence Inc.

One Burlington Woods Drive25 Mall Road

Suite 301A416

Burlington, MA 01803

December 30, 2021January 5, 2024

Dear Fellow Shareholders:

ItOn behalf of Cerence, thank you for your continued investment. We value your support, which is essential to the success of our efforts to deliver long-term value to our shareholders.

While fiscal year 2023 was important in 2021 that the companya transitional year for Cerence, we continued to build on the momentum after its first fiscal year as an independent business and the results speak for themselves. The company reported record revenue and surpassed expectations on nearly all key profitability metrics. The company’s leadership team did an exceptional job of navigatingin conversational AI for the ongoing challenges presented by the continuing impact of COVID-19, to deliver a year in which the company performed well financially, operationally and strategically.

car. Highlights from the fiscal year included:

Company revenue grew 17% year over year despiteSecuring 14 strategic design wins including nine for our Cerence Assistant platform;

| • | Adding nine new customers including two additional two-wheeler customers; |

Achieving five competitive displacements against niche competitors and consumer tech;

| • | Attaining additional wins in AIoT, non-transportation markets; |

Embarking on a product strategy incorporating the negative impact of COVID-19 on automotive productionlatest achievements in Generative AI and Large Language Models (LLMs);

Cerence customers started production on a record 174 car modelsShowing 15 Proof of Concept programs incorporating new Generative AI technology to global OEMs; and

SecuredExceeding top and bottom-line performance expectations set at the first contract inbeginning of the elevator market for conversational AI technologyfiscal year.

Secured $590 million in new bookings driving the company’s backlog to nearly $2 billion atIn fiscal year end

Received bookings of $120 million for new products2023, while the semiconductor shortages and services

Secured five competitive takeaways including three in China

Delivered a steady stream of new products and services

Generated $74.4 million of cash flow from operations (“CFFO”)

COVID-19 has had a dramatic impact on our customers’ ability to produce automobiles thereby providing challenges to our business. This was firstfactory shutdowns throughout the globe due to the shutdown of factoriesCOVID-19 were mainly resolved, macro concerns such as rising interest rates, global economic growth and geopolitical events remained a drag on increases to prevent the spread of the disease, and second, due to shortages of key semiconductor components. With semiconductor content in cars rising at an exponential rate, the shortage of these components will continue to hamper auto production. On a positive note, demand for new cars remains high indicating that as

We refined our long-term product strategy in response to the semiconductor shortage is resolved, production should ramp quickly. Independent third-party research firms expectsignificant advancements in Generative AI and LLMs introduced during the situation to improve as calendar year 2022 unfolds.

Our focus for the year ahead is on what the company can control and I am confident that the executive team, now led by Stefan Ortmanns asfiscal year. This resulted in an evolution of our new CEO, will continue to execute on aDestination Next strategy that keepswe believe will serve us and our customers well in supporting our efforts to create uniquely branded immersive companion experiences for our customers. Led by a management team strengthened with recent additions, Cerence as a central player in the evolution,will remain focused on executing our long-term vision and in some cases revolution, of a car’s infotainment system. The company remains a leader in conversational AIbuilding long-term shareholder value. We look forward to having you join us for the car, and we expect to extend that leadership through innovation and focus, even as we apply our core technology into new, adjacent markets.

As many of you are aware, Stefan Ortmanns was recently named the new CEO and a Director when, Sanjay Dhawan, our former CEO, resigned in December. I would like to thank Sanjay for his leadership and contributions and wish him success going forward. We were very fortunate to have someone of Stefan’s caliber in the company to immediately step into the role without disruption to the business. As the leader of the business that accounts for the vast majority of Cerence revenue today, the Board has come to know Stefan very well and has tremendous respect for his technical expertise, organizational leadership and deep customer contacts. We are truly excited about Stefan’s leadership and his ability to set the course for long-term, sustainable, growth for the company.this journey.

At theour 2024 Annual Meeting of Shareholders, shareholders will be asked to vote on the matters described in the accompanying notice of annual meeting and proxy statement, as well as such other business that may properly come before the meeting and any adjournments or postponements thereof. Your vote is veryimportant to us.Please review the instructions for each voting option described in the notice and in the proxy statement. Your prompt cooperation willbe greatly appreciated.

Sincerely,

|  | |||

| Arun Sarin | Stefan Ortmanns | |||

| Chairman of the Board | Chief Executive Officer | |||

Cerence Inc.

One Burlington Woods Drive25 Mall Road

Suite 301A416

Burlington, MA 01803

NOTICE OF THE 20222024 ANNUAL MEETING OF SHAREHOLDERS

Dear Shareholders:

The 20222024 Annual Meeting of Shareholders (the “2022“2024 Annual Meeting”) of Cerence Inc. (the “Company”) will be held on Wednesday,Thursday, February 2, 202215, 2024 at 11:00 a.m. Eastern Time. The 20222024 Annual Meeting will be a virtual shareholders meeting at www.proxydocs.com/CRNC being held for the following purposes:

| (1) | Election of |

| (2) |

|

Approval, on a non-binding, advisory basis, of the compensation of our named executive officers, as disclosed in this proxy statement; |

|

Transaction of such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

This notice of our annual meeting of shareholders contains details of the business to be conducted at the 2024 Annual Meeting. The Board of Directors has fixed the close of business on December 14, 202118, 2023 as the record date for determination of shareholders entitled to notice of, and to vote at, the 20222024 Annual Meeting and at any adjournments or postponements thereof. A list of shareholders entitled to vote at the 20222024 Annual Meeting will be available at One Burlington Woods Drive,25 Mall Road, Suite 301A,416, Burlington, MA 01803 on the date of, and for ten days prior to, the 20222024 Annual Meeting. To participate in the 20222024 Annual Meeting virtually via the Internet, please visit www.proxydocs.com/CRNC.CRNC. In order to attend, you must register in advance at www.proxydocs.com/CRNC prior to the deadline of February 1, 202213, 2024 at 5:00 pm Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will permit you to submit questions. You will not be able to attend the 20222024 Annual Meeting in person. For instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section titled “Voting” in the Proxy Statementproxy statement and, theif you requested to receive printed proxy materials, your enclosed proxy card.

The Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2021 accompanies this Notice of the 2022 Annual Meeting and the proxy statement. These documents also may be accessed free of charge at www.proxydocs.com/CRNC.

Please refer to the proxy statement for further information with respect to the business to be transacted at the 20222024 Annual Meeting.

Important Notice Regarding the Internet Availability of Proxy Materials for the Shareholder Meeting to be held on February 15, 2024 This Notice of the 2024 Annual Meeting of Shareholders, Proxy Statement and 2023 Annual Report on Form 10-K are available for viewing, printing and downloading at www.proxydocs.com/CRNC. |

By Order of the Board of Directors,

Leanne FitzgeraldJennifer Salinas

Secretary

Burlington, Massachusetts

December 30, 2021January 5, 2024

TABLE OF CONTENTS

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

OF CERENCE INC.

February 2, 202215, 2024

This proxy statement (this “Proxy Statement”) is furnished in connection with the solicitation by Cerence Inc. (“we,” “us,” “our,” “Cerence” or the “Company”) on behalf of the Board of Directors (the “Board” or the “Board of Directors”) of proxies for use at the 20222024 Annual Meeting of Shareholders of the Company to be held virtually on Wednesday,Thursday, February 2, 202215, 2024 at 11:00 a.m. Eastern Time, at www.proxydocs.com/CRNC (the “2022“2024 Annual Meeting”). We intendOn or about January 5, 2024, we will mail to mail thisour shareholders a Notice of Internet Availability containing instructions on how to access our proxy materials, including the Proxy Statement and our Annual Report on Form 10-K for the accompanyingfiscal year ended September 30, 2023. The Notice of Internet Availability also instructs you on how to submit your proxy or voting instructions through the Internet or to request a paper copy of our proxy materials, including a proxy card or voting instruction form that includes instructions on how to submit your proxy or voting instructions by mail or telephone. Other shareholders, in accordance with their prior requests, have received e-mail access to our proxy materials and instructions to submit their vote via the Internet, or have been mailed paper copies of our proxy to shareholders, onmaterials and a proxy card or about December 30, 2021.voting instruction form.

1

PROXYSTATEMENTSUMMARY

This Proxy Statement provides information for shareholders of Cerence, as part of the solicitation of proxies by the Company and its Board of Directors from holders of the outstanding shares of the Company’s common stock (“Common Stock”), for use at the 20222024 Annual Meeting.

This summary highlights select information that is provided in more detail throughout this Proxy Statement. This summary does not contain all of the information you should consider before voting. You should read the full Proxy Statement before casting your vote.

20222024 Annual Meeting

Date and Time:

| ||

| Location: | The meeting is a virtual shareholder |

The following table summarizes the proposals to be considered at the 20222024 Annual Meeting and the Board voting recommendations of the Board of Directors with respect to each proposal.

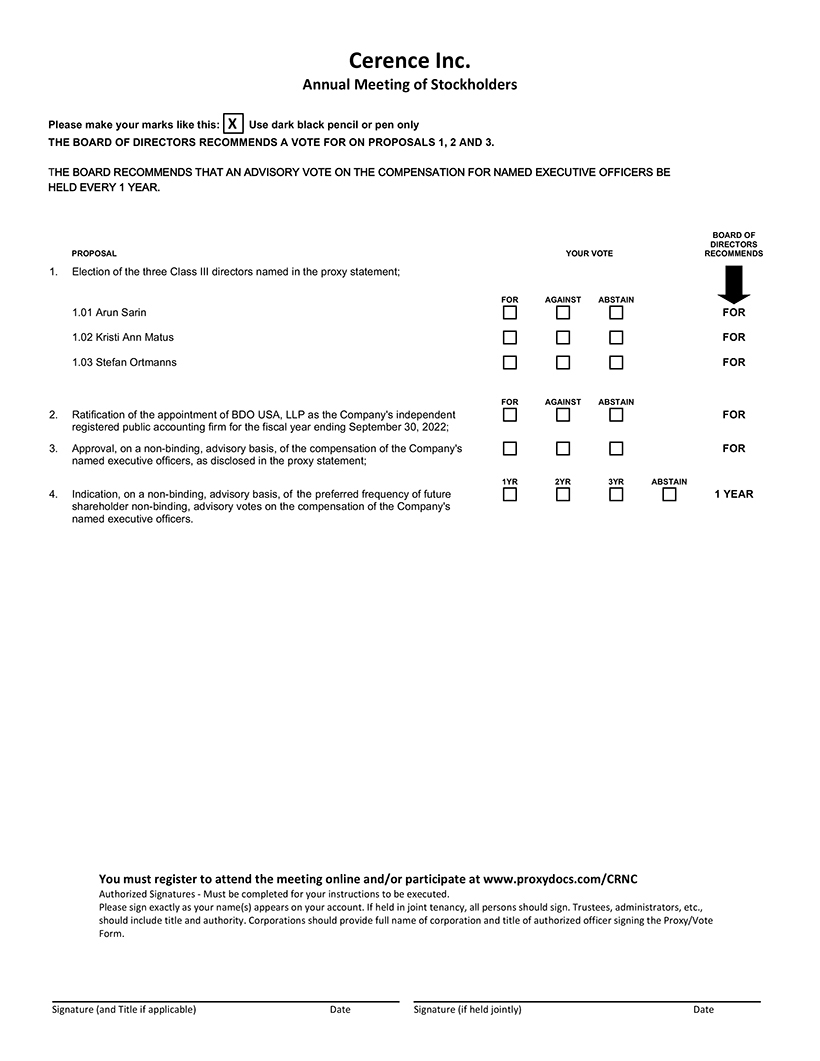

Proposal Number

| Proposal

|

Board Voting

|

Page

Number | |||

1 |

Election of the three nominees named in this Proxy Statement as Class III directors

|

FOR each Director Nominee

|

10 | |||

2 |

|

FOR |

52 | |||

3 |

|

FOR |

54 | |||

4 |

|

ONE YEAR |

55 |

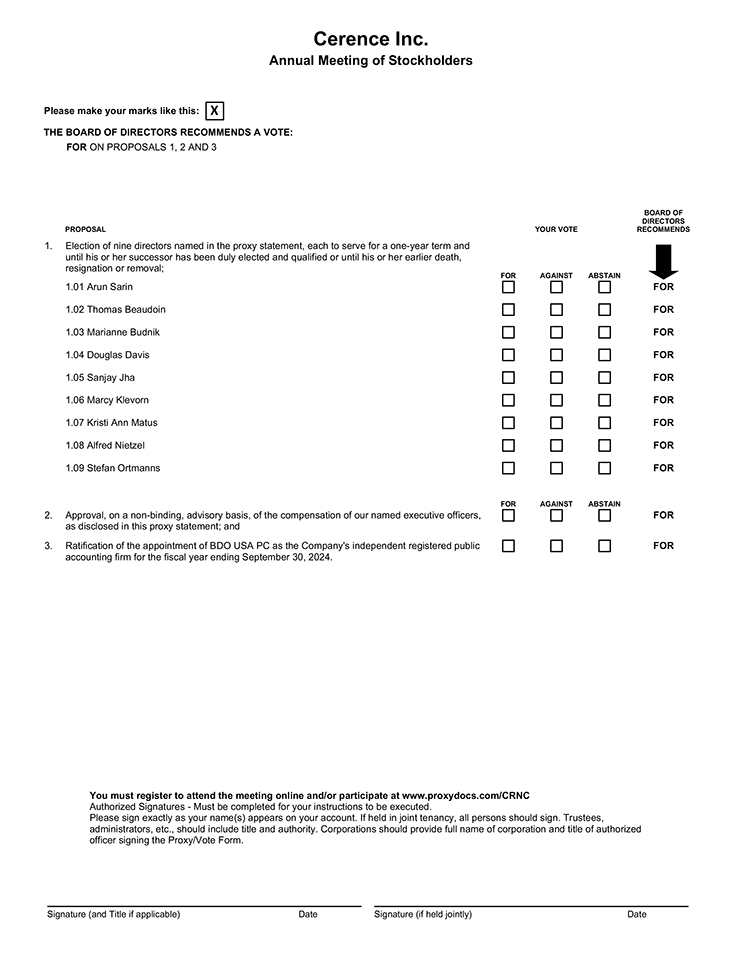

Proposal Number | Proposal | Board Voting Recommendation | ||

1 | Election of director nominees named in this Proxy Statement | FOR each Director Nominee | ||

2 | Approval, on a non-binding, advisory basis, of the compensation of our named executive officers, as disclosed in this Proxy Statement | FOR | ||

3 | Ratification of BDO USA PC as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2024 | FOR |

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on February 15, 2024

We are furnishing proxy materials to our shareholders primarily via the Internet. On or about January 5, 2024, we will mail to our shareholders a Notice of Internet Availability containing instructions on how to access our proxy materials, including the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended September 30, 2023. The Notice of Internet Availability also instructs you on how to submit your proxy or voting instructions through the Internet or to request a paper copy of our proxy materials, including a proxy card or voting instruction form that includes instructions on how to submit your proxy or voting instructions by mail or telephone. Other shareholders, in accordance with their prior requests, have received e-mail access to our proxy materials and instructions to submit their vote via the Internet, or have been mailed paper copies of our proxy materials and a proxy card or voting instruction form.

This Proxy Statement and our Annual Report on Form 10-K are available for viewing, printing and downloading at www.proxydocs.com/CRNC.

A copy of our Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (the “SEC”) on November 29, 2023, will be furnished without charge to any shareholder upon written request to Cerence Inc., 25 Mall Road, Suite 416, Burlington, MA 01803, Attention: Investor Relations.

This Proxy Statement and our Annual Report on Form 10-K are also available on the SEC’s website at www.sec.gov.

Business Overview

Cerence builds AI poweredAI-powered virtual assistants for the mobility/transportation market. Our primary target is the automobile market, but our solutions can apply to all forms of transportation including but not limited to two-wheel

2

vehicles, planes, tractors, cruise ships and elevators. Our solutions power natural conversational and intuitive interactions between vehicles, drivers and passengers, and the broader digital world. We are a premier provider of AI-powered assistants and innovations for connected and autonomous vehicles, including one of the world’s most popular software platforms for building automotive virtual assistants, such as “Hey BMW” and “Ni hao Banma”. Our customers include all major automobile original equipment manufacturers (“OEMs”) or their tier 1 suppliers worldwide, including BMW, Daimler, FCA Group, Ford, Geely, GM, Renault-Nissan, SAIC, Toyota, Volkswagen Group, Aptiv, Bosch, Continental, DENSO TEN, NIO, XPeng and Harman. We deliver our solutions on a white-label basis, enabling our customers to deliver customized virtual assistants with unique, branded personalities and ultimately strengthening the bond between their brands and end users. Our vision is to enable a more enjoyable, safer journey for everyone.

Our platform utilizes industry-leading speech recognition, natural language understanding, speech signal enhancement, text-to-speech, and acoustic modeling technology to provide a conversational AI-based solution. Virtual assistants built with our platform can enable a wide variety of modes of human-vehicle interaction, including speech, touch, handwriting, gaze tracking and gesture recognition, and can support the integration of third-party virtual assistants into the in-vehicle experience.

Our software platform is a market leader for building integrated, branded and differentiated virtual assistants for automobiles. As a unified platform and common interface for automotive cognitive assistance, our software platform provides OEMs and suppliers with an important control point with respect to the mobility experience and their brand value. Our platform is fully customizable and designed to support our customers in creating their own ecosystem in the automobile and transforming the vehicle into a hub for numerous connected devices and services. Virtual assistants built with our software platform can address user requests across a wide variety of categories, such as navigation, control, media, communication and tools. Our software platform is comprised of edge computing and cloud-connected software components and a software framework linking these components together under a common programming interface. We implement our software platform for our customers through our professional services organization, which works with OEMs and suppliers to optimize our software for the requirements, configurations and acoustic characteristics of specific vehicle models.

Recent Event HighlightsOur solutions have been installed in more than 475 million automobiles to date, including over 47 million new vehicles in fiscal year 2023 alone. Based on royalty reports provided by our customers and third-party reports of total vehicle production worldwide, we estimate that approximately 54% of all cars shipped during the fiscal year ended September 30, 2023 included Cerence technologies. Cerence hybrid solutions shipped in approximately 11.0 million vehicles during the fiscal year ended September 30, 2023. In aggregate, over 80 OEMs and Tier 1 suppliers worldwide use our solutions, covering over 70 languages and dialects, including English, German, Spanish, French, Mandarin, Cantonese, Japanese and Hindi.

Since October 1, 2019, we have been an independent publicly tradedpublicly-traded company on The Nasdaq Global Select Market under the symbol “CRNC,” after our former parent company, Nuance Communications, Inc. (“Nuance”), completed the legal and structural separation and distribution to its shareholders of all of our then outstanding shares (the “Spin-Off”“Spin Off”).

Our solutions have been installedRecent Event Highlights

Fiscal year 2023 held many accomplishments across Cerence as we work to transform the mobility experience. We secured important customer wins globally, including securing 14 strategic design wins including nine for our Cerence Assistant platform; adding nine new customers, including two additional two-wheeler customers; achieving five competitive displacements against niche competitors and consumer tech; attaining additional wins in more than 400 million automobilesAIoT, non-transportation markets; embarking on a product strategy incorporating the latest achievements in Generative AI and Large Language Models (LLMs); showing 15 Proof of Concept programs incorporating new Generative AI technology to date, including over 40 million new vehiclesglobal OEMs; and exceeding top and bottom-line performance expectations set at the beginning of the fiscal year.

In fiscal year 2023, we refined our long-term product strategy in fiscal 2021 alone. Based on royalty reports provided by our customersresponse to the significant advancements in Generative AI and third-party reports of total vehicle production worldwide, we estimate that approximately 53% of all shipped carsLLMs introduced during the fiscal year ended September 30, 2021 included year. This resulted in an evolution of our Destination Next strategy that we believe will serve us and our customers well in supporting our efforts to create uniquely branded immersive companion experiences for our customers.

3

Cerence technologies. Cerence hybrid solutions shipped on approximately 8.9 million vehicles duringbelieves good governance is critical to achieving long-term shareholder value. We are committed to governance practices and policies that serve the fiscal year ended September 30, 2021. In aggregate, over 65 automobile brands worldwide uselong-term interests of the Company and its shareholders. The following summarizes certain recent enhancements to our solutions, covering over 70 languagescorporate governance practices and dialects, including English, German, Spanish, French, Mandarin, Cantonesepolicies:

Expanded the size of the Board to nine seats and Shanghainese.further increased the diversity of the Board.

2021 Performance Update

We completed fiscal year 2021 delivering on our strategicExpanded the Compensation Committee’s role in overseeing the Company’s environmental, social and financialgovernance (“ESG”) performance, strategies, goals, and objectives and posting strong operational performance. Some of our highlights include:

Revenue: Our revenue for fiscal year 2021 under generally accepted accounting principles (“GAAP”) was $387.2 million, up 17.0% from $331.0 million in fiscal 2020.

Operating Margin. Our GAAP operating margin in fiscal 2021 was 15.7%, compared to 6.8% in fiscal 2020.

Cash Flow from Operations: Cash flow from operations in fiscal 2021 was $74.4 million, compared to $44.8 million in fiscal 2020.

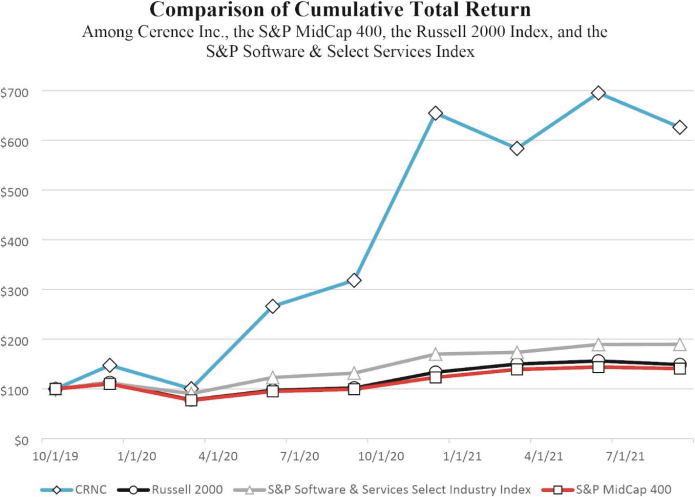

Stock Performance Chart

Our stock performed well in fiscal 2021 as illustrated in the graph below. The graph below compares the cumulative total shareholder return of our common stock since October 1, 2019 with the Russell 2000monitoring evolving ESG risks and the S&P Software & Services Select indices. The information presented assumes an initial investment of $100 on October 2, 2019, the date our common stock began regular-way trading on the Nasdaq Global Select Market. The graph shows the valueopportunities that each of these investments would have had at the end of each quarter.

The comparisons shown in the graph below are based upon historical data. We caution that the stock price performance shown in the graph below is not necessarily indicative of, nor is it intended to forecast, the potential future performance of our Common Stock.

Cerence’s Response to COVID-19

With the onset of the COVID-19 pandemic in 2020, we acted quicklyrelevant to the circumstances and took multiple measures to promote the health and well-being of our employees in order to support our employees and customers.

Beyond implementing measures, such as enhanced hygiene, cleaning and sanitization protocols and early travel restrictions, we made the decision to have our employees in China work-from-home and then followed with a transition of nearly all of our employees to work-from-home, quickly transforming the way we do business to keep our employees, their families and communities safe. The manner in which we developed our internal systems during our first year as an independent company enabled us to quickly pivot to different work environments in an accelerated manner, while ensuring our employees remain engaged, highly productive and continuing to meet our business objectives and customer commitments.

Corporate Sustainability and Responsibility

We recognize the close connection between our success and our ability to make a positive impact on our customers, employees and our communities. These efforts help to make us an employer of choice and promote our brand, while increasing our ability to continuously improve our technologies and solutions which support profitable and responsible growth. We have recently published our first Environmental, Social and Governance Report (“ESG Report”) on our sustainability page at cerence.com/sustainability. The reference to our ESG Report is not intended to incorporate information in the report or from our website into this Proxy Statement by reference.Committee’s oversight responsibilities.

| • | Updated our policy governing transactions in our securities by directors, officers and employees regarding trading plans complying with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended. |

| • | Amended and restated our by-laws in connection with recent changes to SEC rules and the Delaware General Corporation Law and after a review of corporate governance matters. |

Board of Directors

Our Board of Directors has a diverse mix of directors with complimentarycomplementary qualifications, skills, expertise, experience and attributes, which is essential to ensuring effective oversight of our business strategy and corporate governance practices. The members of the Board are:

|

Arun Sarin Independent Board Chairman Former CEO, Vodafone Group Plc. |

Seasoned global technology and telecommunications executive. |

| Sanjay Jha Former CEO GlobalFoundries, Inc., Motorola Mobility Devices and COO Qualcomm | Extensive knowledge and leadership of technology organizations with significant global management experience. | |||||

| Stefan Ortmanns President and CEO | Expert in technologies, services, software and go-to-market strategy for the automotive industry. |

|

| ||||||

| Thomas Beaudoin Chief | Abundance of executive, finance, and operational experience in global technology companies. |

| Kristi Ann Matus Former CFO and COO, Buckle Agency | Finance and accounting expert with extensive enabled services experience. | |||||

| Marianne Budnik Chief Marketing Officer, VAST Data | Seasoned technology marketing executive at high growth companies. |

| Alfred Nietzel Former CFO, CDK Global Inc. | Finance and accounting expert with extensive | |||||

|

|

4

All of our non-employeeindependent directors have extensive professional experience.experience relevant to their service on our Board. The chart below highlights specific areas in which we believe our directors have particularly deep experience relevant to our current profile and strategic needs. In this regard, during 2023, Ms. Klevorn joined our Board bringing extensive experience in the automotive and mobility industries.

Skills and Qualifications

|

|

|

|

|

|

|

|

| ||||||||

Board Diversity We are an organization

| ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Business/Industry Knowledge We are a software, solutions and professional services organization benefiting from experienced directors knowledgeable in the industry, markets and

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Financial We are a global publicly traded company conducting complex financial transactions requiring oversight of the processes associated with our financial management and the integrity of our financial results.

| ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Global/Emerging Markets Experience We are a global organization participating in both mature and emerging markets, and benefit from a Board with prior international exposure and experience.

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Leadership We are a complex, global organization benefiting from experienced oversight of our overall strategy and management, including assessing our strategies and operations.

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Technology/Innovation We are a leading provider of cognitive assistants using voice recognition and natural language understanding solutions in highly dynamic and competitive markets and benefit from experience in understanding market trends and disruptive technologies and solutions.

| ✓ | ✓ | ✓ | ✓ | ✓ |

Board Diversity Matrix

We value diversity and believe that diversity among the directors as to professional and personal experiences is desirable, and the chartboard diversity matrix below highlights thesummarizes certain self-identified personal diversitycharacteristics of our Board members.board members as of November 8, 2023. No directors self-identified as a person with a disability or military veteran.

| Board Diversity Matrix for Cerence Inc. | ||||||||

As of 11/08/2023

| ||||||||

| Total Number of Directors | 9 | |||||||

| Female | Male | Non- Binary | Did Not Disclose Gender | |||||

| Part I: Gender Identify | ||||||||

| Directors | 3 | 6 | ||||||

| Part II: Demographic Background | ||||||||

| African American or Black | ||||||||

| Alaskan Native or Native American | ||||||||

| Asian | 2 | |||||||

| Hispanic or Latinx | ||||||||

| Native Hawaiian or pacific Islander | ||||||||

| White | 3 | 4 | ||||||

| Two or More Races or Ethnicities | ||||||||

| LGBTQ+ | ||||||||

| Did Not Disclose Demographic Background | ||||||||

|

|

|

|

|

|

| ||||||||||||||||||

|

|

| ||||||||||||||||||||||

|

|

| ||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||

6

Corporate Governance

We are committed to good corporate governance, which we believe promotes the long-term interests of our shareholders, fosters sustained business success, and strengthens our Board of Directors and management accountability. We have the following practices in place to assist us in managing risk in order to promote the long-term interests of our shareholders.

✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ | Annual election of directors Separate Chairman and CEO Substantial majority of independent directors 100% independent committee members Independent directors meet regularly without management present Shareholder right to call special meetings Majority voting in director elections with resignation policy Proxy access Annual say-on-pay vote | ✓ | ||||

| review of committee charters and governance policies and procedures | ||||||

✓ |

| |||||

✓ | Stock ownership requirement for directors and named executive officers, with CEO at 5x annual base salary | |||||

✓ | Anti-hedging and pledging policies | |||||

✓ | No automatic acceleration of equity awards upon a “change of control” | |||||

✓ | Use of independent compensation consultant to Compensation Committee | |||||

✓ | Compensation Clawback Policy | |||||

| ||||||

| ||||||

| ||||||

VOTING

Each share of Common Stock entitles the holder thereof to one vote on each of the matters to be acted upon at the 20222024 Annual Meeting, including the election of directors. Votes cast online or by proxy at the 20222024 Annual Meeting will be tabulated by Mediant Communications, Inc., the Inspector of Elections. Any proxy that is voted according to the instructions included in the proxy card will be voted in accordance with the instructions thereon, and if no instructions are given, will be voted: (1) “FOR” the election of the threenine director nominees described in Proposal One,One; (2) “FOR” ratification of the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm described in Proposal Two, (3); “FOR” approval, on a non-binding, advisory basis, of the compensation of our named executive officers, as disclosed in this Proxy Statement and as described in Proposal Three,Two; and (4) “ONE YEAR”(3) “FOR” ratification of the appointment of BDO USA PC as the preferred frequency for future non-binding, advisory shareholder votes on the compensation of our named executive officers.Company’s independent registered public accounting firm described in Proposal Three. A shareholder may indicate when it votes by the Internet, by telephone or on the enclosed proxy that it is abstaining from voting on a particular matter (an “abstention”). A broker may indicate that it does not have discretionary authority as to certain shares to vote on a particular matter (a “broker non-vote”). Abstentions and broker non-votes are each tabulated separately.

The Inspector of Elections will determine whether or not a quorum is present at the 20222024 Annual Meeting. In general, Delaware law and our Second Amended and Restated By-laws (“By-laws”) provide that a majority of the shares of Common Stock issued and outstanding and entitled to vote, present online or represented by proxy, constitutes a quorum. Abstentions and broker non-votes of shares that are entitled to vote are treated as shares that are present online or represented by proxy for purposes of determining the presence of a quorum.

For Proposal 1 (Election of Class III Directors), each nominee receiving a majority of the votes cast will be elected. For this purpose, a majority of the votes cast means the number of votes cast for a director nominee must exceed the votes cast against that director nominee, with abstentions and broker non-votes not counted as a vote cast with respect to that director nominee. Each director nominee has provided an irrevocable resignation effective upon such person’s failure to receive a majority of the votes cast in an uncontested election. If such director nominee fails to receive a majority of the votes cast, then the Board shall consider such resignation and may either accept such resignation or reject such resignation and seek to address the underlying cause of the vote. The Board shall decide whether to accept or reject the resignation within 90 days following the certification of the shareholder vote. Once the Board makes this decision, the Company will promptly make a public announcement of the Board’s decision, including, in the event that the Board rejects the resignation, a statement regarding the reasons for its decision.

For Proposal 2 (Ratification(Approval, on a non-binding, advisory basis, of the appointmentcompensation of BDO USA, LLP as the Company’s independent registered public accounting firm for fiscal year 2022)our named executive officers), an affirmative vote of a majority of the shares of Common Stock entitled to vote thereon and who are present online or represented by proxy is required to approve the proposal. In determining whether this proposal has been approved, abstentions are treated as present online or represented by proxy and entitled to vote, but not as voting for such proposal, and hence have the same effect as votes against such proposal. Because this proposal is a non-binding, advisory vote, the result will not be binding on our Board, our Compensation Committee, or us. However, our Board and our Compensation Committee value input from and the opinions of our shareholders and intend to consider the outcome of the vote when determining the compensation of our named executive officers. Proposal 2 is considered a non-routine matter for which brokers do not have discretionary voting power, and therefore, broker non-votes will have no effect on Proposal 2.

For Proposal 3 (Ratification of the appointment of BDO USA PC as the Company’s independent registered public accounting firm for fiscal year 2024), an affirmative vote of a majority of the shares of Common Stock entitled to vote thereon and who are present online or represented by proxy is required to approve the proposal. In determining whether this proposal has been approved, abstentions are treated as present online or represented by proxy and entitled to vote, but not as voting for such proposal, and hence have the same effect as votes against such proposal. Proposal 23 is considered a routine matter for which brokers have discretionary voting power.

For Proposal 3 (Approval, on a non-binding, advisory basis, of the compensation of our named executive officers), an affirmative vote of a majority of the shares of Common Stock present online or represented by proxy is required to approve the proposal. In determining whether this proposal has been approved, abstentions have no effect on such proposal. Because this proposal is a non-binding, advisory vote, the result will not be binding on our Board, our Compensation Committee, or us. Our Board and our Compensation Committee will consider the outcome of the vote when determining the compensation of our named executive officers. Proposal 3 is considered a non-routine matter for which broker non-votes are not considered to have been voted “For” or “Against” a particular proposal, and therefore will have no effect on Proposal 3.

For Proposal 4 (Indication, on a non-binding, advisory basis, of preferred frequency of future shareholder non-binding, advisory votes on the compensation of our named executive officers), the frequency receiving the highest number of votes from the voting power of shares of Common Stock present online or by proxy and entitled to vote will be considered the frequency preferred by the shareholders. In determining the result, abstentions have no effect on such proposal. Because this proposal is a non-binding, advisory vote, the result will not be binding on our Board, our Compensation Committee, or us. Our Board and our Compensation Committee will consider the outcome of the vote when determining how often we should submit to the shareholders future non-binding,

advisory votes to approve the compensation of our named executive officers. Proposal 4 is considered a non-routine matter for which broker non-votes are not considered to have been voted “For” or “Against” a particular proposal, and therefore will have no effect on Proposal 4.

All shareholders may vote their shares over the Internet, by telephone or during the annual meeting by going towww.proxydocs.com/CRNC. If you requested and/or received a printed version of the proxy card, you may also vote by mail.

| • | By Internet.You may vote atwww.proxypush.com/CRNC, 24 hours a day, seven days a week. You will need the control numberincluded in your Notice of Internet Availability or proxy |

By Telephone. You may vote using a touch-tone telephone by calling 1-866-390-5267, 24 hours a day, seven days a week. You will need the control number included on your proxy card. Votes submitted by telephone must be received before the polls close at the 2022 Annual Meeting on February 2, 2022.8

By Mail. You may submit your vote by completing, signing and dating each proxy card received and returning it promptly in the prepaid envelope we have provided. Sign your name exactly as it appears on the proxy card. Proxy cards submitted by mail must be received no later than by February 2, 2022 at 11:00 a.m. Eastern Time to be voted at the 2022 Annual Meeting.

| • | By Telephone. You may vote using a touch-tone telephone by calling 1-866-390-5267, 24 hours a day, seven days a week. You willneed the control number included on your Notice of Internet Availability or proxy card (if you received a printed copy of the proxy materials). Votes submitted by telephone must be received before the polls close at the 2024 Annual Meeting on February 15, 2024. |

| • | By Mail. If you received proxy materials, you may submit your vote by completing, signing and dating each proxy card received andreturning it promptly in the prepaid envelope we have provided. Sign your name exactly as it appears on the proxy card. Proxy cards submitted by mail must be received no later than February 15, 2024 at 11:00 a.m. Eastern Time to be voted at the 2024 Annual Meeting. |

| • | During the Annual Meeting.You may vote during the annual meeting by going towww.proxypush.com/CRNC. You will need thecontrol number included on your Notice of Internet Availability or proxy |

If you hold your shares through a bank, broker or other nominee, please see the materials they sent to you for information about how to vote before the meeting.

If you vote via the Internet or by telephone, your electronic vote authorizes the named proxies in the same manner as if you signed, dated and returned your proxy card. If you vote via the Internet or by telephone, do not return your proxy card.

VIRTUAL ANNUAL MEETING

The 20222024 Annual Meeting will be a completely virtual meeting. ThereWe continue to use the virtual annual meeting format to facilitate shareholder attendance and participation by leveraging technology to communicate more efficiently with our shareholders. As such, there will be no physical meeting location. Thelocation, and the meeting will only be conducted via live webcast.

In order to attend, you must register in advance at www.proxydocs.com/CRNC prior to the deadline of January 31, 2021February 13, 2024 at 5:00 p.m. Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you to access the meeting and you will have the ability to submit questions, and vote at the meeting. Please be sure to follow instructions found on your Notice of Internet Availability or proxy card (if you received a printed copy of the proxy materials), and/or Voting Instruction Form and subsequent instructions that will be delivered to you via email.

RECORD DATE AND SHARE OWNERSHIP

Holders of record of Common Stock as of the close of business on December 14, 202118, 2023 have the right to receive notice of and to vote at the 20222024 Annual Meeting. On December 14, 2021,18, 2023, the Company had 39,162,33941,237,489 shares of Common Stock issued and outstanding.

PROXIES

Proxies for use at the 20222024 Annual Meeting are being solicited by the Company from its shareholders. Any person giving a proxy in the form accompanying this Proxy Statement has the power to revoke it at any time before its exercise by (1) filing with the Corporate Secretary of the Company a signed written statement revoking his, her or its proxy orproxy; (2) submitting an executed proxy bearing a date later than that of the proxy being revoked.revoked; or (3) by submitting a new vote over the Internet or by telephone. A proxy also may be revoked by attendance at the 20222024 Annual Meeting and voting online. Attendance at the 20222024 Annual Meeting will not by itself constitute the revocation of a proxy. All proxies will be voted in accordance with the instructions contained in those proxies. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. On any other matters properly brought before the 2024 Annual Meeting, the named proxies shall vote in accordance with their best judgment.

9

SHAREHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR THE 20232025 ANNUAL MEETING OF SHAREHOLDERS

Shareholders may present proper proposals or nominations for consideration at the Company’s 20232025 Annual Meeting of Shareholders (the “2023“2025 Annual Meeting”) by submitting their proposals or nominations in writing to the Company’s Corporate Secretary in a timely manner. Our Amended and Restated By-laws require that certain information and acknowledgements with respect to the proposal or nomination be set forth in the shareholder’s notice. A copy of the relevant By-law provision is available upon written request to Cerence Inc., One Burlington Woods Drive,25 Mall Road, Suite 301A,416, Burlington, MA 01803, Attention: Investor Relations. In addition, the By-laws were have been filed as Exhibit 3.2 toby the Company’s Current Report on Form 8-K, filedCompany with the U.S. Securities and Exchange Commission (the “SEC”) on October 2, 2019SEC and may be accessed through the SEC’s website at www.sec.gov.

Inclusion of Shareholder Proposals in Proxy Statement

Proposals of shareholders that are intended to be presented at the 20232025 Annual Meeting must comply with the requirements of SEC Rule 14a-8. A shareholder’s proposal must be delivered to or mailed and received by us no later than September 1, 20227, 2024 in order for it to be included in the Company’s proxy statement and form of proxy relating to the 20232025 Annual Meeting.

Inclusion of Director Nominees in Proxy Statement

Our By-laws provide that a shareholder, or group of up to 20 shareholders, that has owned continuously for at least three years an aggregate of at least 3% of the outstanding Common Stock, may nominate and include in the Company’s proxy materials director nominees constituting up to the greater of two or 20% of the number of directors in office as of the deadline for such nomination, provided that the shareholder(s) and nominee(s) satisfy the requirements in the By-laws (a “proxy access nomination”). To be timely, a nomination notice and required information must be delivered to or mailed and received by the Company’s Corporate Secretary at our principal executive offices not less than 120 days nor more than 150 days prior to the anniversary of the date that the definitive proxy statement with respect to the preceding year’s annual meeting was first released to shareholders; provided, however, that in the event the date of the annual meeting is more than 30 days earlier or more than 60 days later than such anniversary date, notice by the shareholder to be timely must be so delivered or received no earlier than the 150th150th day prior to such annual meeting and not later than the close of business on the later of (1) the 120th120th day prior to such annual meeting or (2) the 10th10th day following the date on which we publicly announce the meeting date. Assuming the date of our 20232025 Annual Meeting is not so advanced or delayed, shareholders who wish to include a director nominee in our 20232025 proxy statement must notify us no earlier than August 2, 20228, 2024 and no later than the close of business on September 1, 2022.7, 2024. Such notice must provide the information required by our By-laws.

In addition, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), no later than December 27, 2024.

Inclusion of Shareholder Proposals or Nominations in Annual Meeting Agenda but Not in Proxy Statement

A shareholder proposal or a nomination for director to be presented at the 20232025 Annual Meeting that is not to be included in the Company’s proxy statement and form of proxy relating to the meeting must be delivered to or mailed and received by the Company’s Corporate Secretary at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary of the date of the immediately preceding annual meeting as first specified in the Company’s notice of meeting; provided, however, that in the event the date of the annual meeting is more than 30 days earlier or more than 60 days later than such anniversary date, notice by the shareholder to be timely must be so delivered or received no earlier than the 120th120th day prior to such annual meeting and not later than the close of business on the later of the 90th90th day prior to such annual meeting or the 10th10th day following the date on which we publicly announce the meeting date. Assuming the date of our 20232025 Annual Meeting is not so advanced or delayed, shareholders who wish to include a director nominee in our 20232025 proxy statement must notify us no earlier than October 5, 202218, 2024 and no later than the close of business on November 4, 2022.17, 2024. Such notice must provide the information required by our By-laws.

10

PROXY SOLICITATION COSTS

The expense of solicitation of proxies will be borne by the Company. In addition to solicitation of proxies by mail, certain officers, directors and Company employees, who will receive no additional compensation for their services, may solicit proxies by telephone or in person. The Company is required to request brokers and nominees who hold stock in their name to furnish this proxy material to beneficial owners of the stock and will reimburse such brokers and nominees for their reasonable out-of-pocket expenses in so doing. In addition, we have engaged Proxy Advisory Group LLC to assist in the solicitation of proxies and provide related advice and informational support for a service fee, plus the reimbursement of customary disbursements, which are not to exceed $35,000 in total.

11

ELECTION OF CLASS III DIRECTORS

Our Board of Directors is currently divided into three classes. Our Amended and Restated Certificate of Incorporation provides that, until the 2023 Annual Meeting (the annual meeting in the year that is three years after the Spin-Off), our Board will be so divided into three classes, with each class consisting, as nearly as may be possible, of one-third of the total number of directors. The directors designated as Class III directors have terms expiring at the 2022 Annual Meeting, and the directors designated as Class I directors stood for election at the 2020 Annual Meeting of Shareholders and have terms expiring at our 2023 Annual Meeting. The directors designated as Class II stood for election at the 2021 Annual Meeting of Shareholders, and have terms expiring at our 2023 Annual Meeting. As a result, beginning at the 2023 Annual Meeting, all of our directors will stand for election each year for annual terms, and our Board will no longer be divided into three classes.

At the 20222024 Annual Meeting, threenine directors will be elected to the Board. The Nominating & Governance Committee of the Board of Directors recommended, and the Board of Directors approved, Arun Sarin, Stefan Ortmanns, Thomas Beaudoin, Marianne Budnik, Douglas Davis, Sanjay Jha, Marcy Klevorn, Kristi Ann Matus and Arun SarinAlfred Nietzel, as nominees for election at the 20222024 Annual Meeting as Class III directors. The term of office of eachEach person elected as a Class III director will continuebe elected for a one-year term expiring at the 2025 Annual Meeting. Directors hold office until the 2023 Annual Meeting or until a successor hastheir successors have been duly elected and qualified, or until his or hertheir earlier death, resignation or removal.

The names of and certain biographical information about the directors in each of the three classesdirector nominees are set forth below. The information below also includes the specific experience, qualifications, attributes and skills that led to our Board’s conclusion that the nominees should serve as a director of Cerence or, with respect to each director who is not standing for election at the 2022 Annual Meeting, that the Board would expect to consider if it were making a conclusion currently as to whether he or she should serve as a director.Cerence. There are no family relationships among any of our directors or executive officers.

Information Regarding the Nominees for Election as Class III Directors

Board Nominee | Qualifications | |

|

| |

|

| |

Arun Sarin Age:

Independent Chairman of the Board and Nominating & Governance Committee Chair Board Member since: October 2019

|

Mr. Sarin served as Chief Executive Officer of Vodafone Group Plc from 2003 until his retirement in 2008. Mr. Sarin began his career at Pacific Telesis Group in 1984. He progressed through various management positions there and at AirTouch Communications Inc., from which Pacific Telesis spun off in 1994, and was named President and Chief Operating Officer of AirTouch in 1997. After AirTouch merged with Vodafone in 1999, he was appointed Chief Executive Officer of Vodafone’s U.S./Asia-Pacific region. He left Vodafone in 2000 to become Chief Executive Officer of Bluecora (fka InfoSpace, Inc.), and from 2001 until 2003, he served as Chief Executive Officer of Accel-KKR Telecom. Mr. Sarin rejoined Vodafone in 2003 as its group Chief Executive Officer. After his retirement from Vodafone in 2008, he served as a senior advisor to Kohlberg Kravis Roberts & Co. for five years. Mr. Sarin currently serves as

|

Information Regarding the Continuing Directors

12

Stefan Ortmanns Age: 60

Board Member since: December 2021 | Dr. Ortmanns was appointed our President and CEO on December 15, 2021. Prior to his appointment as President and CEO, Dr. Ortmanns served as our Executive Vice President, Core Products from October 1, 2019 until December 14, 2021, overseeing research and development operations, product management and strategic partnership management. Prior to his appointment as Executive Vice President, Core Products, he was with Nuance and served as its Executive Vice President and General Manager of the Automotive Division from March 2018 until his appointment as our Executive Vice President. As GM of the Automotive Division of Nuance, Dr. Ortmanns was responsible for hybrid, conversational AI-powered solutions for the digital car and automotive-related services that are used by almost all the world’s leading automotive manufacturers. He joined Nuance in 2003 and previously held other positions at Nuance including SVP of Engineering and Professional Services for the former Mobile Division. Dr. Ortmanns started working in the speech industry in 1993. Before he joined Nuance, he worked at Philips Speech Processing, Bell Labs, Lucent Technologies, and the University of Technology Aachen. He holds degrees in mechanical engineering and computer science and a Ph.D. in computer science. With more than 30 years of technology leadership and extensive experience in the automotive industry, Dr. Ortmanns brings a deep understanding of AI and machine learning applications, particularly in the automotive sector, all of which we believe makes him well qualified to serve as a member of our Board. | |

Board Member since: October 2019 | Mr. Beaudoin has served as our Chief Financial Officer since May 2022. Previously, he served as Chief Transformation Officer at Qualifacts Systems Inc. and Credible Inc. from April 2021 to April 2022, as Executive Vice President Business Transformation of Nuance from 2017 until 2020, where he was responsible for leading efforts to align and fully leverage technologies within Nuance’s key vertical markets and driving growth while improving margins and cost structure. Prior to re-joining Nuance in | |

Marianne Budnik Age: 55

Compensation Committee and Board Member since: October 2019

|

|

13

Douglas Davis Age: 62

Nominating & Governance Committee and Strategic Committee Member Board Member since: May 2022 | Mr. Davis served in various positions at Intel Corporation from 1984 until his retirement in 2019, most recently serving as Senior Vice President of Intel’s Automated Driving Group from 2017 to 2019, which included responsibility for forming the company’s automated driving business, establishing Intel as a leading supplier of chip technology for autonomous vehicles, and leading the company’s acquisition of Mobileye. From 2015 until 2017, Mr. Davis served as Senior Vice President and General Manager of Intel’s Internet of Things group. Mr. Davis is currently a director for Oshkosh Corporation and Verra Mobility. Mr. Davis holds a M.B.A. from the Arizona State University W.P. Carey School of Business and a Bachelor’s Degree in Electrical Engineering from New Mexico State University, Mr. Davis is a technology industry veteran who brings to our Board strong global strategic planning experience and business leadership qualities, as well as valuable experience and relationships within the automotive, autonomous driving and IoT industries, which we believe makes him well qualified to serve as a member of our Board.

| |

Sanjay Jha Age:

Audit Committee Member Board Member since: October 2019

|

Mr. Jha is currently an investor and a board member of several privately held companies. Previously, Mr. Jha was a General Partner at Eclipse Ventures from

| |

Marcy Klevorn Age: 64

Compensation Committee and Nominating & Governance Committee Member Board Member since: June 2023 | Ms. Klevorn is a known and respected automotive and mobility industry leader, having spent 35 years at Ford Motor Company. During her tenure, she held varying executive and leadership roles within the company’s information technology organization, including global Chief Information Officer (CIO) and, previously, CIO of Ford Motor Company in Europe. Ms. Klevorn also served as EVP and President of Ford Mobility, where she oversaw Ford Smart Mobility LLC and its acquisitions and other investments that accelerated the company’s plans to design, build, grow, and invest in emerging mobility services. In this role, she also chaired the board of Ford Autonomous Vehicles LLC. Ms. Klevorn most recently served as the Chief Transformation Officer of Ford Motor Company, where she accelerated Ford’s transformation efforts by refining its corporate governance and fostering adoption of process improvements and agile teams. She also led partnerships with key technology partners and played a critical role in the company’s diversity, equity and inclusion efforts until her departure in 2019. Ms. Klevorn currently sits on the Boards of Directors of Northern Trust Corporation and Humana and on the Provost Advisory Committee at the University of Michigan. She holds a bachelor’s degree in business from the University of Michigan Stephen M. Ross School of Business. Ms. Klevorn has extensive automotive and mobility industry and transformation expertise as well as corporate governance and key leadership skills developed through her decades of experience, all of which we believe makes her well qualified to serve as a member of our Board.

|

Kristi Ann Matus Age: 55

Audit Committee Chair Board Member since: September 2019 | Ms. Matus served as the CFO and COO of Buckle Agency LLC from 2020 to July 2022. From 2017 until 2020, Ms. Matus was an executive advisor to Thomas H. Lee Partners. From 2014 to 2016, Ms. Matus served as the Executive Vice President, Chief Financial and Administrative Officer at athenahealth, Inc. From 2012 to 2013, Ms. Matus served as Executive Vice President and Head of Governmental Services at Aetna, Inc. Prior to Aetna, she held several senior leadership roles at United Services Automobile Association, including Executive Vice President and Chief Financial Officer from 2008 to 2012. She began her career at Thrivent where she held various financial and operational roles for over a decade. Ms. Matus currently serves as a director at Ambac Financial Group, Inc., and she has previously served as a director of Alliance Bernstein Holding L.P., Equitable Holdings, Nextech Systems, Tru Optik Data Corp., and Jordan Health Services, Inc. Ms. Matus holds a B.S. degree from University of Wisconsin, Oshkosh. Ms. Matus has extensive management and financial expertise as well as corporate governance and key leadership skills developed through her decades of experience, all of which we believe makes her well qualified to serve as a member of our Board. | |

Alfred Nietzel Age:

Compensation Committee Chair and

Board Member since: October 2019

|

Mr. Nietzel has been an independent consultant since 2017. From 2014 to 2017, Mr. Nietzel served as the Chief Financial Officer and Executive Vice President at CDK Global, Inc., a leading provider of software and information technology solutions to the automotive retail sector. Prior to CDK Global’s spin-off, Mr. Nietzel was with Automatic Data Processing, Inc. (“ADP”) since 2001 and served as Chief Financial Officer for the Dealer Services Division, Chief Financial Officer for the Employer Services Division and as ADP’s Corporate Controller. Prior to joining ADP, Mr. Nietzel served for 17 years with Proctor & Gamble Inc. in numerous financial management roles in the United States, United Kingdom, and Australia. Mr. Nietzel currently serves as the Chairman of the Board of One Span Inc. and as a director at Baxter Credit Union. Mr. Nietzel holds a B.S. degree from Eastern Illinois University. Mr. Nietzel led and orchestrated the financial and administrative execution of the spin-off creating CDK Global in 2014 and has extensive management and corporate experience and financial expertise, all of which we believe makes him well qualified to serve as a member of our Board.

|

|

| |

|

| |

|

| |

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF STEFAN ORTMANNS, KRISTI ANN MATUS AND ARUN SARINTHE NINE NOMINEES LISTED ABOVE TO SERVE AS CLASS III DIRECTORS.

CORPORATE GOVERNANCE

Corporate Governance Overview

We are committed to good corporate governance, which we believe promotes the long-term interests of our shareholders and strengthens our Board of Directors and management accountability. Highlights of our corporate governance practices include the following:

| ✓ | Annual |

| ✓ | Separate Chairman and CEO |

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ | More than 50% of Board members are women or come from a diverse background |

| ✓ |

|

| ✓ |

|

| ✓ |

|

Proxy access |

| ✓ |

|

Annual Board |

Framework

We have developed a corporate governance framework designed to ensure our Board has the opportunity, authority and practices to review, advise and evaluate our business operations and make decisions independent of management. Our goal is to align the interests of directors, management and shareholders and comply with or exceed the requirementrequirements of Nasdaq, and applicable laws and regulations. TheThis framework establishes the practices our Board follows with respect to Board meetings, involvement of senior management, director compensation, CEO performance evaluation, management succession planning and Board committees.

| Our Key Corporate Governance Documents |

✓ Amended and Restated Certificate of Incorporation ✓ Second Amended and Restated ✓ Corporate Governance Guidelines ✓ Code of ✓ Director and Executive Stock Ownership Policy |

✓ Compensation Committee Charter ✓ Nominating & Governance Committee Charter ✓ Audit Committee Charter ✓

✓ Comprehensive Compensation Clawback Policy | |||||

Role of the Board

Our business is managed under the direction of the Board. Management has primary responsibility for the day-to-day operations and affairs of our Company and the role of the Board is to provide independent oversight of management. In its oversight role, the Board, as a whole and through its committees, is responsible for establishing broad corporate policies and reviewing our overall performance. The Board selects and provides for the succession of executive officers and, subject to shareholder election, directors. The Board also evaluates the performance of our Chief Executive Officer, and approves the compensation of our Chief Executive Officer after considering the recommendations of our Compensation Committee. The Board reviews and approves corporate objectives, strategies and annual investment plans, and evaluates significant policies and proposed major commitments of corporate resources. The Board also participates in decisions that have a potential major economic impact on our company. Management keeps our directors informed of Company activity through regular communication, including written reports and presentations at Board and committee meetings, as well as through regular informal updates between meetings with all or a subset of Board members.

16

Board Leadership Structure

Our current leadership structure splits the roles of CEO and Chairman, with Mr. Sarin serving as our independent Chairman. Our Corporate Governance Guidelines provide our Board of Directors with flexibility to select the appropriate leadership structure based on the specific needs of our business and the best interests of our shareholders. If the Chairperson of the Board is not independent, the Board will appoint a Lead Independent Director upon the recommendation of the Nominating & Governance Committee, which will be a director who qualifies as independent under the applicable rules of Nasdaq.

Independence of our Board

Under the Nasdaq Marketplace Rules, a director will qualify as an “independent director” if, in the opinion of our Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Having an independent Board is core to our governance practices. Our Board is comprised of sevennine directors. The Board has determined that Mr. Sarin, Ms. Budnik, Mr. Davis, Mr. Jha, Ms. Klevorn, Ms. Matus and Mr. Nietzel are independent under the director

independence standards of Nasdaq and the SEC, including Rule 10A-3(b)(1) under the Securities Exchange ActAct. The Board has also determined that each member of 1934, as amended (the “Exchange Act”)each standing committee of the Board is independent. Dr. Ortmanns, our Chief Executive Officer, and Mr. Beaudoin, our Chief Financial Officer, are not considered “independent directors”. In making these determinations, the Board solicited information from each of our directors regarding whether such director, or any member of his or her immediate family, had a direct or indirect material interest in any transaction involving Cerence, or its former parent, or received personal benefits outside the scope of such person’s normal consideration.

Key Elements of Board Independence

| ✓ |

|

| ✓ | Executive sessions of independent directors – At each quarterly Board meeting, time is set aside for the independent directors to meet in executive session without management present. Additional executive sessions are held as needed. |

| ✓ | Committee independence – Only independent directors are members of the Board’s committees. Each committee meets regularly in executive session. |

| ✓ | Independent compensation consultant – The compensation consultant retained by the Compensation Committee is independent of the Company and management as |

| ✓ | Independent Board Chair – Arun Sarin currently serves as independent Chair of the Board. Key responsibilities include: |

Calling meetings of the Board and independent directors and non-employee directorsdirectors;

Setting the agenda for Board meetings in consultation with the CEO, the Corporate Secretary, and other directorsdirectors;

Chairing executive sessions and coordinating activities of the independent directorsdirectors; and

Leading the Board’s annual CEO performance evaluationevaluation.

Corporate Governance Guidelines

The Board is governed by its Corporate Governance Guidelines, which were adopted by the Board in September 2019 and are available under “Governance“Leadership and Governance – Governance Documents & Committee Charters” in the Investors section of our website, www.cerence.com. These guidelines cover, among other items, the following significant topics:

Board Selection Process and Qualifications. The Nominating & Governance Committee is responsible for reviewing the appropriateskills and characteristics required of prospective Board members and is responsible for recommending to

17

the Board candidates for directorship. The Nominating & Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that will best serve the interests of the Company and its shareholders. The Board believes that candidates for director should have certain minimum qualifications, including: (1) the highest personal and professional ethics and integrity; (2) skills that are complementary to those of the existing Board; (3) proven achievement and competence in the nominee’s field; (4) relevant expertise upon which to be able to offer meaningful advice and guidance to management and make significant contributions to the Company’s success; (5) sufficient time to devote to affairs of the Company and contribute to the Company’s goals; (6) demonstrated excellence in their field; (7) the ability to exercise sound business judgment; (8) the ability to meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to Audit Committee members; and (9) an understanding of the fiduciary responsibilities that are required of a member of the Board and the commitment of time and energy necessary to diligently carry out those responsibilities. Among the criteria the Board may consider are experience and diversity, and, with respect to diversity, the Board may consider such factors as gender, race, ethnicity, differences in professional background, experience at policy making levels in business, finance and technology and other areas, education, skill, and other individual qualities and attributes. The Board endorses the value of seeking qualified directors from backgrounds relevant to the Company’s mission, strategy and business operations and perceived needs of the Board at a given time.

Director’s Eligibility, Education, and Term of Office.Directors may not serve on the board of directors of more than four other publiccompanies without first obtaining specific approval from the Board. Each director is required to notify the Chairman and the Chair of the Nominating & Governance Committee prior to accepting service on the board of any other public company. Each director also is required to notify the Chairman and the Chair of the Nominating & Governance Committee upon a change in principal professional responsibilities. The Nominating & Governance Committee may consider such change of status in recommending to the Board whether the director should continue serving as a member of the Board. The Board encourages, and the Company will reimburse the costs associated with, directors participating in continuing director education. The Board does not presently believe that it should establish term limits or a

mandatory retirement age, as term limits and mandatory retirement ages may result in the loss of long-serving directors who over time have developed unique and valuable insights into our business and therefore can provide a significant contributions to the Board. As an alternative to term limits or a mandatory retirement age, the Board will routinely evaluate the directors and evaluate the need for changes to Board composition based on an analysis of skills and experience necessary for the Company.

Board Leadership.The leadership of the Board shall include a Chairman of the Board and, if the Chairman of the Board is notindependent, there shall be a Lead Independent Director recommended by the Nominating & Governance Committee who shall be independent under the applicable rules of Nasdaq. The Chairman of the Board or the Lead Independent Director, as applicable, shall serve as the focal point for independent directors in resolving conflicts with the CEO, or other independent directors, and coordinating feedback to the CEO on behalf of independent directors regarding business issues and Board management.

Committees. The current committee structure of the Board includes the following standing committees: Audit, Compensation, andNominating & Governance. Additional committees may be created or disbanded upon approval of the Board. The Nominating & Governance Committee recommends, and the full Board approves, the composition of the Board’s standing committees. The charter of each standing committee is subject to review periodically to determine that the charter continues to address the purposes for which the committee was formed.

Creation of Strategic Committee. On August 1, 2023, in accordance with its charter, the Nominating & Governance Committee recommended, and the full Board approved, the formation of a new ad hoc committee called the Strategic Committee to oversee the implementation by management of the Company’s strategy. The Strategic Committee reviews with management the development of the Company’s strategy, including the strategic direction and initiatives of the Company and the risks associated with its strategy; meets with management periodically to monitor the Company’s progress against its strategic goals; and ensures the Board is regularly apprised of the Company’s progress with respect to implementation of any approved strategy. The Strategic Committee consists of independent directors Mr. Jha and Mr. Davis, with Mr. Jha chairing the committee.

18

Standing Committees of the Board of Directors

The composition, duties and responsibilities of the standing committees of our Board of Directors are as set forth below. Each of these committees has a written charter approved by our Board. Copies of these committee charters are available, without charge, upon request in writing to Cerence Inc., One Burlington Woods Drive,25 Mall Road, Suite 301A,416, Burlington, MA 01803, Attention: Corporate Secretary, or under “Governance“Leadership and Governance – Governance Documents & Committee Charters” in the Investors section of our website, www.cerence.com.

The table below provides current membership for each standing committee of the Board.Board:

Director | Audit | Compensation | Governance | ||||||||||||||||

Arun Sarin

|

|

|

| ||||||||||||||||

|  | ||||||||||||||||||

| |||||||||||||||||||

Marianne Budnik |

|

|

|

|

|

| |||||||||||||

Sanjay Jha

|  | ||||||||||||||||||

Marcy Klevorn |

|

|

|

|

|

| |||||||||||||

Kristi Ann Matus

|

|

|

| ||||||||||||||||

Alfred Nietzel

|

|

|

|

|

|

|  | ||||||||||||

Stefan Ortmanns

| |||||||||||||||||||

Chair

Chair  Member

Member  Financial expert

Financial expert

Functions of the Standing Committees

Audit Committee

The Audit Committee held

Current Committee Members:

• Kristi Ann Matus (Chair) • Sanjay Jha • Alfred Nietzel |

Primary Responsibilities

The Audit Committee was established in accordance with Section 3(a)(58)(A) and Rule 10A-3 under the Exchange Act. The responsibilities of our Audit Committee are more fully described in our Audit Committee charter (the charter is available under “Leadership and Governance – Committee Charters” in the Investors section of our website, www.cerence.com), and they include, among other duties:

• Appointing, approving the compensation of, and assessing the engagement and independence of our independent registered public accounting firm;

• Pre-approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm;

• Reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us;

• Considering matters relating to our accounting policies and coordinating the oversight and reviewing the adequacy of our internal controls over financial reporting;

• Inquiring about significant risks, reviewing our policies for enterprise risk assessment and risk management, and assessing the steps management has taken to control these risks;

• Establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns;

• Monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters;

• Preparing the Audit Committee report required by the SEC to be included in our annual proxy statement;

• Reviewing all related person transactions for potential conflict of interest situations and approving all such transactions;

• Reviewing the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing our financial statements and reviewing whether non-audit services provided by the independent registered public accounting firm affect the accountants’ independence; and

• Reviewing the scope of our annual audits.

Financial Expertise and Independence

The Audit Committee has three members, each of whom is financially literate and meets the enhanced independence standards established by the Sarbanes-Oxley Act of 2002 and related rulemaking of the SEC. In addition, our Board has determined that Ms. Matus and Mr. Nietzel are audit committee financial experts as defined by Item 407(d)(5)(ii) of Regulation S-K of the Exchange Act.

Report

The Audit Committee Report is included in this Proxy

|

Compensation Committee

The Compensation Committee held

Current Committee Members:

• • Marianne Budnik • |

Primary Responsibilities

The responsibilities of our Compensation Committee are more fully described in our Compensation Committee charter (the charter is available under “Leadership and Governance – Committee Charters” in the Investors section of our website, www.cerence.com), and they include, among other duties:

• Overseeing compensation plans, policies and benefit programs applicable to our executive officers;

• • Recommending and reviewing on a periodic basis the compensation payable to our directors in connection with their service on the Board and/or any committees of the Board;

• Overseeing the administration of our

• Reviewing and discussing with management the Company’s “Compensation Discussion and Analysis” section included in its proxy statement and producing a report on executive compensation to be included in the proxy statement; and

• Assessing the results of the most recent advisory vote on executive compensation and taking such assessment into consideration when establishing or recommending the compensation of the Company’s executive officers.

Independence

The Compensation Committee consists entirely of independent directors, each of whom

Report

The Compensation Committee Report is included in this Proxy Statement.

| |

Nominating & Governance Committee

The Nominating

Current Committee Members:

• Arun Sarin (Chair) • Marianne Budnik • • Marcy Klevorn |

Primary Responsibilities

The responsibilities of our Nominating & Governance Committee are more fully described in our Nominating & Governance Committee charter (the charter is available under “Leadership and Governance – Committee Charters” in the Investors section of our website, www.cerence.com), and they include, among other duties:

• Overseeing our corporate governance practices;

• Considering and reporting to our Board on matters relating tothe identification, selection and qualification of candidates to serve as directors;

• Reviewing and discussing with the CEO and reporting to the Board development and corporate succession plans for the non-CEO members of the executive team;

• • Periodically reviewing environmental, social and governance matters

• Recommending to our Board on an annual basis the candidates to be nominated by our Board for election as directors at our annual meeting of shareholders; and

• Overseeing our Board’s annual

Independence

The Nominating & Governance Committee consists entirely of independent directors, each of whom

|

21

Compensation Committee Interlocks and Insider Participation